'Reaching for yield' into corporate debt takes on a risky hue

October 2021

William White, a Canadian, became the top economist at the Bank for International Settlements (BIS) over a 14-year career to 2008 at the bank owned by central banks. Among those who heard of him, White became known as “the man no one wanted to hear”.[1]

From 2003, in an era when central banks prioritised inflation targeting (and yet the response to every crisis by the ‘maestro’ Federal Reserve chairman Alan Greenspan was to slash the US cash rate), White and his team studied the data the BIS gathered on banks worldwide. They judged that low interest rates meant too much money was sloshing around. They observed a bubble developing in US housing. They noted the obscure way mortgages were being securitised. They spotted the stellar ratings on dodgy mortgage-backed securities. They observed the increase in risky loans.

White ensured that BIS publications were sprinkled with warnings that bubbles lead to financial upheavals.[2] On top of that, White aired his concerns through speeches and papers.

Two of White’s efforts stood out. The first was in 2003 at Jackson Hole in the US at the annual gathering of central bankers that included Greenspan, who then publicly snubbed White for his remarks.[3] What upset Greenspan was that White warned that, even though inflation was docile, liberalised financial markets allowing investors to take too much risk meant that “financial imbalances could build up … possibly resulting in financial instability” so damaging that “central banks may need to push policy rates to zero”.[4] White’s other warning of note was a 2006 paper titled Is price stability enough? In it, White concluded that "one hopes that it will not require a disorderly unwinding of current excesses to prove convincingly that we have indeed been on a dangerous path" by targeting inflation only.[5]

The US subprime crisis of 2007 that morphed into the global financial crisis of 2008 was, of course, that chaotic unravelling. While no household name, White is acknowledged as the economist who foresaw the calamity, and the BIS is regarded as among the foremost voices on financial risks.

That is the context in which to view a paper the BIS released in March this year that warns about the “bankruptcy gap”. This term refers to the difference between expected and actual – “very low” – global bankruptcies since the pandemic began, even fewer insolvencies in some countries.[6] The BIS said ample credit from banks and the corporate-debt market means lockdown-hit companies in “airline, hotel, restaurant and leisure sectors" in particular are surviving on debt, not economic viability. “The more worrying scenario is the combination of higher debt levels and depressed earnings for credit-dependent firms”, the BIS said, essentially warning that a spate of defaults could threaten financial stability.

The concerns are centred on the lower-rated – or ‘junk’ – segments of the corporate debt market – where the US$11 trillion US market (of which about US$3 trillion is junk debt), as the world’s benchmark, gets outsized attention. So too does China’s US$17 trillion corporate-debt market, where recent defaults and property giant Evergrande’s woes pushed the average yield on Chinese high-yield bonds issued offshore from 9.56% on June 30 to 15.45% at the end of September.[7]

The risky form of finance that gained in global popularity from the 1980s has turned more hazardous due to ultra-loose monetary policies and the decision by key central banks to backstop their corporate bond markets – most notably, the Fed’s historic decision in March last year to buy US investment-grade corporate bonds.[8] The combination prompted investors to pile into risky company debt to earn their required returns.

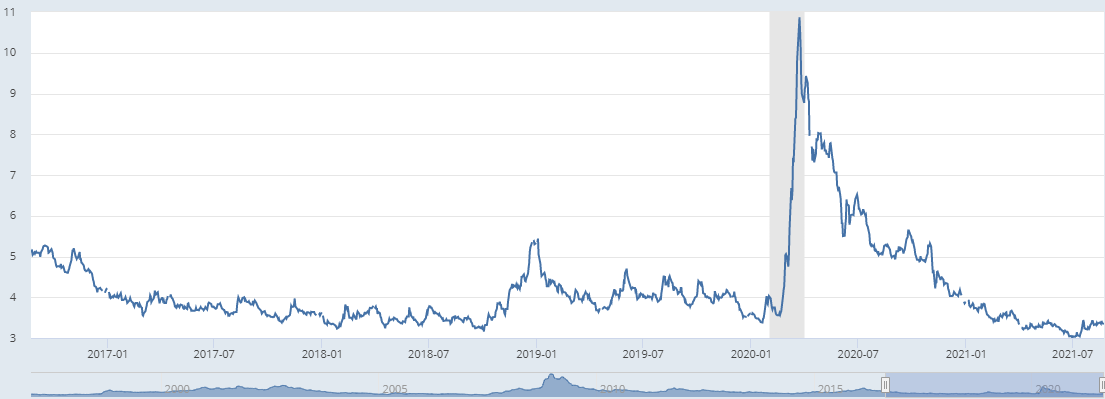

This ‘reach for yield’ means that junk bonds are priced at little premium over investment-grade corporate debt and government bonds. In the US on September 30, for instance, the ICE BofA US High Yield Index Option Adjusted Spread of junk to government bonds had plunged from a record of 11.38% just before the Fed began buying corporate bonds on March 23 last year to only 4.21% on September 30, not far above the 3.94% set on September 15, its lowest since just before the subprime crisis of 2007.[9] Given that companies have used record low interest rates to lengthen the maturity of their debt holdings – and default risk rises over time – the barometer is at a de facto historic low.

The rating companies are sounding similar concerns to the BIS (as, less directly, is the OECD).[10] Moody’s and S&P Global Ratings told the Financial Times in August that a borrowing frenzy amounting to a record US$786 billion[11] in “speculative-grade” (the junkiest) debt so far in 2021 amid “clear signs of risk taking” meant “the current easy access to corporate financing might be laying the foundation for a future debt crisis” from “elevated levels of defaults”.[12] The frenzy this year comes after a record US$1 trillion was invested in corporate debt.

The wider concern is the systemic threat. Even if any corporate-bond crisis fails to inflict such damage, higher company debt loads foreshadow a downturn because higher repayments would force businesses to shed staff and refrain from investing as they prioritised reducing their debts (a ‘balance sheet’ recession, in the jargon).

The risks around speculative-grade corporate debt raise the broader question of whether or not prolonged central-bank asset buying, by forcing investors to take excessive risk, could prove counterproductive. The verdict on the worth of quantitative easing will be obvious if junk bonds are at the centre of the next crisis.

Let’s acknowledge that bond investors helped many viable companies survive an emergency. Let’s note too that the BIS is not pushing the warnings about the bankruptcy gap with the same urgency with which White voiced his concerns. Many forecasts obviously prove inaccurate, including those of the BIS, which is prone to alarm. If higher inflation proves transitory as officials expect, low interest rates could persist for a while yet and the reach for yield might prove innocuous. But benign investment markets might only prompt more investors to seek higher and riskier debt-based returns and that might presage a delayed, but bigger, blow-up. A crisis could start in many of the asset classes (including US housing again)[13] that have reached record highs in recent years. For sure. But problems arising anywhere could spread to junk bonds and magnify any upheaval.

As household-name Warren Buffett warned in February 2020 as covid-19 was going global: “Reaching for yield is really stupid” that could have major “consequences over time”.[14] No doubt White in his near-anonymity would agree.

No way out

On 23 May 2013, minutes were released from the Fed’s policy-setting board meeting held about three weeks earlier. The document showed one board member, Esther George, president (still) of the Federal Reserve Bank of Kansas City, disagreed with the decision to keep monetary policy ultra-loose – where the cash rate was at zero and the Fed was buying assets worth US$85 billion a month. George “preferred to signal a near-term tapering of asset purchases”, the record showed.[15] That phrase was among warnings about impending rises in bond yields that triggered such a violent reaction on financial markets the episode became known as the ‘taper tantrum.’

The same day those minutes were released, Fed chairman Ben Bernanke justified an expected tapering by warning Congress that a long period of low interest rates could “undermine financial stability” … because “investors or portfolio managers dissatisfied with low returns may reach for yield by taking on more credit risk, duration risk or leverage”.[16]

Jerome Powell now leads a Fed that is buying assets at a rate of at least US$120 billion a month, whereby the central bank creates money (electronically) as an asset on its balance sheet and buys financial securities in the secondary market with interest-paying reserves. As the Fed’s balance sheet has bloated by US$6 trillion over the past eight years to stretch to 30% of US GDP (while the total of major central banks is US$18 trillion), the risks are probably greater. While central-bank asset buying in emergencies can stabilise financial markets (as the Fed’s corporate-bond buying did in 2020), the question being raised as investors await signs of an imminent tapering is whether prolonged asset buying might prove counterproductive.

Disadvantages accruing from quantitative easing (some of which are intertwined with the zero cash-rate setting) build the case for why the asset buying needs to be unwound as soon as it can. One drawback is that asset buying lowers bond yields and thereby hurts savers who rely on interest income. That counteracts, to some extent, the boost lower rates give to the economy. Another is that quantitative easing seems to bolster asset prices to such an extent that risk appears mispriced and capital appears misallocated, while inequality rises. A third is that central-bank asset purchases create a future fiscal liability for taxpayers, even if it reduces government borrowing costs in the short term and the interest earned on a central bank’s debt holdings is income for the treasury. Central banks pay a market-based rate of interest to holders of their reserves to stop these sums being lent out and risking inflation. Higher interest rates would thus burden public finances while giving banks unearned income. A fourth is that quantitative easing shortens the duration of the government’s debt (by substituting overnight reserves for longer-term securities) at a time when low interest rates mean the government should be doing the opposite.

Another is that quantitative easing undermines the independence of central banks – and thus their inflation-fighting credibility – by blurring the distinction between fiscal and monetary policies. A sixth is that, given the fragility of central-bank independence come an emergency, elevated government debt could prompt politicians to pressure central banks not to raise interest rates to control inflation because higher rates might trouble public finances. A further drawback is that central-bank actions can reduce the pressure on political leaders to use fiscal and other policies to help economies, especially if the asset buying reaches into funding the government’s deficit.

Last, and of relevance to the corporate-debt market, the asset buying can encourage excessive risking taking that results in a crisis. That’s why central banks are afraid to reduce, let alone end, their purchases. The UK’s House of Lords might best sum up this dilemma with the title of its evaluation of central-bank asset buying: Quantitative Easing – a dangerous addiction? As the report notes in what it calls “the no-exit paradigm,” no central bank has managed to reverse its asset buying over the medium to long term.[17] The Fed has probably come closest. Many argue the economy could have absorbed Fed tapering in 2013.

The concern now is that Fed tapering could well be the spark of trouble for corporate bond yields. Faster inflation – and US consumer prices jumped 5.4% in the 12 months to August – could hasten the day when the Fed needs to tighten monetary policy.

Come any tapering, government yields are likely to rise and so too the premium on junk versus haven assets. At the same time, higher interest rates could slow economic growth and retard company sales. Yet interest payments would still need to be paid and maturing debt replaced by fresh borrowings. Yields on downgraded company debt could soar if the rating reduction were to sink from investment to non-investment grade. Debt reduced to junk (‘fallen angels’) reduces the number of investors who can invest because they have mandated minimum ratings on investments.

Fed members have much to consider as they ponder the ending of the Fed’s promiscuous monetary policy, though there’s less pressure on Kansas City’s George as she has no vote this time.[18] Wonder what the BIS’s White, now in retirement, might advise.

By Michael Collins, Investment Specialist

ICE BofA US High Yield Index Option Adjusted Spread since 2016

Source: ICE data indices. fred.stlouisfed.org. (Chart found at fred.stlouisfed.org/series/BAMLH0A0HYM2/

[1] Spiegel International. ‘The man nobody wanted to hear. Global banking economist warned of coming crisis.’ 7 August 2009. spiegel.de/international/business/the-man-nobody-wanted-to-hear-global-banking-economist-warned-of-coming-crisis-a-635051.html

[2] The 2004 annual report charted the risk-taking of US investment banks and warned “uncertainties concerning the housing market could imply some direct and indirect risks to the financial system”. Bank for International Settlements. ‘75th annual report. 1 April 2004 – 31 March 2005.’ Pages 131 to 134. 27 June 2005. bis.org/publ/arpdf/ar2005e.pdf. The 2005 annual report noted US subprime mortgage originations in 2005 were seven times 2000 levels and that in the US and the UK “relaxation of lending standards due to competition and greater reliance on securitisation has contributed to a significant increase in lending to more risky households”. Bank for International Settlements. ‘76th annual report. 1 April 2005-31 March 2006.’ Page 134. bis.org/publ/arpdf/ar2006e.pdf. The credit risk transfer report of January 2003 is noted for its warnings. bis.org/publ/cgfs20.pdf

[3] Spiegel International. Op cit.

[4] Claude Borio and William White. BIS working papers No. 147. ‘Whither monetary and financial stability? The implications of evolving regimes.’ February 2004 dated version of paper presented in Jackson Hole, Wyoming on 28 to 30 August 2003. bis.org/publ/work147.pdf

[5] William White. BIS Working Papers No. 205. Is price stability enough? April 2006. bis.org/publ/work205.pdf

[6] Ryan Banerjee, Joseph Noss and Jose Maria Vidal Pastor. BIS Bulletin. No 40. ‘Liquidity to solvency: Transition cancelled or postponed?’ 25 March 2021. Bankruptcies “even fell” in many jurisdictions during 2020. bis.org/publ/bisbull40.pdf

[7] Bloomberg data. Bloomberg Asia Ex-Japan US dollar credit China HY Index.

[8] Federal Reserve. Primary Market Corporate Credit Facility. Set up 23 March 2020. federalreserve.gov/monetarypolicy/pmccf.html

[9] Federal Reserve Bank of St Louis. Federal Reserve economic data. ICE BofA US High Yield Index Option Adjusted Spread. (BAMLHOAOHYM2). fred.stlouisfed.org/series/BAMLH0A0HYM2. On September 30, for instance, the average yield for bonds in the ICE BofA US High Yield Index was only 4.21%. By comparison, the yield on 10-year US government bonds was 1.52%. Three years earlier to the day, the equivalent reading on the High Yield Index was 6.23% compared with 2.85% on the US 10-year Treasury. FRED. ICE BofA US High Yield Index Effective Yield. (BAMLHOAOHYM2EY). fred.stlouisfed.org/series/BAMLH0A0HYM2EY. US Department of the Treasury. Resources center. Daily Treasury yield curve rates 2018. treasury.gov/resource-center/data-chart-center/interest-rates/pages/TextView.aspx

[10] The latest OECD report on corporate bonds warned that in comparison to past ‘credit cycles’ the stock of outstanding corporate bonds “has lower overall credit quality, higher payback requirements, longer maturities and inferior investor protection” – and that was before the pandemic hit. OECD. ‘Corporate debt continues to pile up.’ Undated but February 2020. oecd.org/corporate/corporate-bond-debt-continues-to-pile-up.htm

[11] ‘Junk-debt sales soar toward record year.’ The Wall Street Journal, quoting numbers for S&P. 19 September 2021. wsj.com/articles/junk-debt-sales-soar-toward-record-year-11632043982

[12] ‘Rating agencies caution on corporate debt after US borrowing frenzy.’ Financial Times. 18 August 2021. ft.com/content/32a57864-d983-46b0-bbfa-85fd2d2361e5

[13] On August 26, South Korea becomes first big Asian economy to raise interest rates after the central Bank of Korea decided fears over record household debt outweigh surging Covid threat. See Newsweek. ‘Are we about to repeat the 2008 housing crisis?’ Philip Pilkington. 20 August 2021. newsweek.com/are-we-about-repeat-2008-housing-crisis-opinion-1620249

[14] CNBC. ‘Warren Buffett’s sobering advice: ‘Reaching for yield is really stupid but very human.’ 24 February 2020. cnbc.com/2020/02/24/warren-buffett-reaching-for-yield-is-really-stupid-but-very-human.html

[15] Federal Reserve. ‘Minutes of the meeting of April 30 – May 1, 2013.’ Page 9. Released 22 May 2013. federalreserve.gov/monetarypolicy/files/fomcminutes20130501.pdf

[16] Federal Reserve. Chairman Ben Bernanke. Testimony. ‘The economic outlook.’ Before the Joint Economic Committee, US Congress. 22 May 2021. federalreserve.gov/newsevents/testimony/bernanke20130522a.htm

[17] House of Lords. Economic Affairs Committee. First report of sessions 2021-22. ‘Quantitative Easing – a dangerous addiction?’ 16 July 2021. Page 52. publications.parliament.uk/pa/ld5802/ldselect/ldeconaf/42/42.pdf

[18] Federal Reserve. Federal Open Markets Committee. ‘About the FMOC.’ federalreserve.gov/monetarypolicy/fomc.htm

Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 (‘Magellan’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan.