Stock Story: American Water

October 2023

Few utilities in Magellan’s infrastructure universe are in a position to leverage their scale in the same way as American Water Works (NYSE: AWK).

As the largest listed water utility in the US, American Water has the advantage of scale that is central to its business model and overall strategy. The company leverages this scale primarily through purchasing power, cheaper financing and efficient labour, which ultimately leads to lower costs. This may be less of a priority for some utilities but for American Water this is critical. This scale allows the company to:

1. Invest in and expand the asset base. Under its regulatory scheme, reducing operating costs allows American Water to increase its asset base investments without causing large increases in customer bills. The company estimates that for every US$1 of expense it can save, the utility can invest as much as US$8 into the asset base and still keep customer bills unchanged. For American Water shareholders, this means the company is generating a return on the US$8 investment instead of recovering that one dollar of expense.

2. Better compete on acquisitions. As much as it is about the price being paid to purchase a water utility, acquisitions still need approval from a government/regulatory body. Authorities will often ask for assurances from the buyer that customer rates will either decline or hold steady for an extended period. In these instances, American Water’s ability to offer prospective customers more affordable utility bills (due to its scale) gives the company a competitive advantage when it comes to obtaining government and regulatory approval.

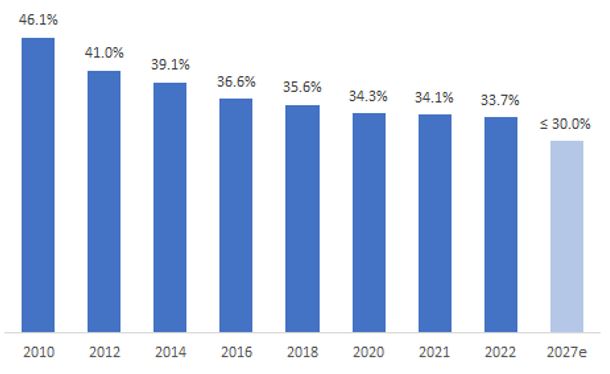

Exhibit 1 illustrates American Water’s operating and maintenance expense as a proportion of revenues, showing a sustained downward trend since 2010 driven by leverage of overhead costs and ongoing productivity. Over the period between 2010 and 2022, American Water has reduced its expense ratio by more than 12% despite acquiring more than 400,000 new customers.

Exhibit 1: Operating Cost-to-Revenue Ratio

Source: American Water Investor Presentation (August 2023)

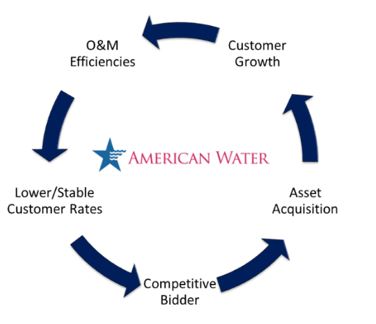

Flywheel effect

When American Water began trading in 2008 following its IPO, the company began a major operational restructure to address its 48.5% Operation and Maintenance efficiency ratio. This naturally took some time to see an improvement (due to legacy processes and contracts) but costs eventually started to plateau, and revenues gradually increased with customer growth. Unbeknownst to most, this marked the start of the flywheel effect for American Water.

As presented in Exhibit 2, the cost efficiencies American Water was able to realise translated into a lower cost base. This subsequently gave American Water a competitive advantage when it came to acquiring other water utilities. The lower cost base meant that with economies of scale, American Water could offer prospective customers lower utility bills. It also meant American Water could offer a marginally higher price for a utility because it could achieve better cost synergies. Naturally, the proposition of affordable utility bills, as well as a competitive price, attracted sellers seeking to offload their water systems.

As American Water added new customers via acquisitions, it logically grew both the customer and asset base. This allowed American Water to extract more from its cost base, resulting in even greater cost efficiency. The leverage and efficiency subsequently enabled the company to make its next acquisition. This, in short, was American Water’s flywheel turning and creating long-term sustainable earnings growth.

Exhibit 2: American Water’s Flywheel

Source: Magellan

Of course, this raises the question: How specifically does American Water create operating leverage following an acquisition? As with any company with a large, fixed cost base, operating leverage comes from spreading costs over a larger customer base. American Water will use its buying power to bulk-purchase materials and equipment (e.g. chemicals, pipes, valves, construction materials, etc.) to lower the unit costs of the newly acquired utility. This operating leverage is particularly high when the business acquires a neighbouring utility, where it can maximise labour and resources.

Also underappreciated in the American Water investment thesis is the state of the US water market. American Water operates in a highly fragmented market where 84% of water systems in the US are still publicly owned. This is even more the case in the wastewater market where 98% of customers are served by municipal, local and state government entities. The fragmented state of the US water market has been slow to change over the years due in part to regulatory and government limitations. These restraints have, however, started to lift with the introduction of new state legislation and regulatory changes that better facilitate transactions. We believe that other factors such as the growing number of municipalities dealing with escalating budgetary pressures and rising debt burdens will also help push market consolidation.

“Selling the sewer system to New Jersey American Water was the right decision for our community. With private ownership of the system, the borough will eliminate the need for significant rate increases going forward and borrowing money for future improvements will end. Somerville will then be able to fund other needed projects, the sewer system will be maintained and improved on a consistent basis, and sewer rates will remain stable…” – Somerville Mayor Dennis Sullivan (3 October 2023)

Either way, we believe that American Water will be a primary beneficiary of a consolidating market due to the inherent advantages discussed above. This has become particularly evident in management’s outlook for the company, which indicates that regulated acquisitions will grow four-fold in 2023 (in dollar terms; versus 2020) with another ~1.3m new customer additions in the pipeline1. Acquisitions, of course, reveal only part of the overall American Water story, as Exhibit 3 shows the growth in regulated investments expected to occur over the next decade, which should translate into about 8-9% annual asset base growth.

Exhibit 3: Regulated Capital Investments (US$ in billions)

Source: American Water Investor Presentation (August 2023)

As with all infrastructure investments, American Water’s growth isn’t immune to risks and challenges. The utility is subject to many of the same risks as any regulated utility investment – regulatory, interest rate and macroeconomic risks. We believe American Water offers infrastructure investors a superior blend of long-term, low-risk and predictable earnings. Over the long term, American Water’s simple-yet-effective business model provides us with comfort that it has the potential to achieve its guided 7-9% earnings and dividend CAGR over the next decade in a risk-averse way.

A pure water play

The history of American Water traces to 1886 when the American Water Works & Guarantee Company was founded. While much happened in between, 2003 was a year of note because American Water was acquired then by the German utility RWE, which then listed the company in 2008 via a ‘spin-off’.

Today, American Water remains a stand-alone pure-play water business. The most important is the regulated business, which provides water and wastewater services to about 1,600 communities in 14 states. The unit’s assets consist of more than 53,000 miles (85,000+ kilometres) of pipes, 540 water-treatment plants, 1,100 wells, 175 wastewater plants, 1,100 water-storage facilities and 1,700 pumping stations. This regulated business brings in more than 90% of the company’s revenue. Approximately 26% of regulated revenue is sourced from New Jersey while another 23% comes from Pennsylvania.

American Water’s other business is the Military Service Group, where the subsidiary provides water services to 18 US military bases under 50-year contracts with the US government.

By Jowell Amores, Portfolio Manager

Source: Company filings

Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 (‘Magellan’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan.