DOWNLOAD PDF

DOWNLOAD PDF  (Complete quiz for 0.25 hours)

(Complete quiz for 0.25 hours)

The strategy invests in listed infrastructure companies that Magellan consider to be high quality and that we expect to generate reliable long-term earnings that ultimately lead to reliable investment returns.

In addition to reliable underlying earnings, the portfolio is exposed to structural growth that could potentially enhance returns to investors. For example, the transition of the global economy to net-zero emissions will require significant investment in renewable energy, electricity transmission and distribution that will enable regulated electricity utilities to grow their assets and earnings. Similarly, ongoing economic growth will lead to increased road and aviation traffic that can be expected to increase revenues and earnings for toll roads and airports.

Monetary policy tightening by central banks in recent years has hampered the investment performance of listed infrastructure. While current performance has not met our expectations, the underlying earnings of infrastructure and utilities companies in our defined investable universe have proven to be reliable in the face of the rising interest rate environment. As monetary conditions stabilise, we expect these reliable and increasing earnings of infrastructure companies to grow the wealth of investors in these assets.

We seek to build a portfolio of outstanding infrastructure and utility companies that generate predictable long-term earnings, which form the bedrock of reliable long-term investment returns for infrastructure investors.

The types of infrastructure assets in which the strategy invests are generally natural monopolies that provide essential services to the community. These are services required by communities to enable people and businesses to go about their daily lives. Such services include the provision of energy, water and transport.

services to the community. These are services required by communities to enable people and businesses to go about their daily lives. Such services include the provision of energy, water and transport.

It is clear that the fundamental need for these services means demand for the infrastructure that provides such services is reliable through the economic cycle.

We exclude from our defined infrastructure investment universe those companies whose earnings are exposed to factors that can lead to significant unexpected changes to earnings. By avoiding companies whose earnings are less predictable, we limit our investment universe to companies that provide investors with predictable, through-the-cycle, inflation-linked returns. Companies we exclude from our investment universe are those whose earnings are threatened by direct competition, by sovereign risk (particularly where property rights are considered under threat) and by changes in commodity prices.

The universe of infrastructure assets we consider for the strategy comprises two sectors:

Utilities and infrastructure companies provide essential services while facing limited, if any, competition. Because the services are indispensable, the prices charged can be adjusted with limited impact on demand. As a consequence, earnings are more reliable than those for a typical industrial company and generally enjoy inherent protection against inflation. Over time, the stable revenue or cash flow streams derived from infrastructure assets are expected to deliver income and capital growth for investors.

Over the 17 years we have been managing infrastructure investments, we have faced many periods of investment market uncertainty. Ultimately, the use of a conservatively defined infrastructure investment universe has meant the long-term earnings derived by the companies in which we invest have grown in a predictable manner and this has led to reliable long-term wealth accumulation for investors.

Two key secular variables have affected the investment performance of the strategy in recent periods. Commodity prices, particularly oil and energy prices, have remained elevated and inflation-adjusted (real) interest rates have risen over the year.

The rise in oil and energy prices has benefited the investment performance of the benchmark as the benchmark index constituents include companies whose earnings are linked to commodity prices.

Magellan excludes companies whose earnings are linked to commodity prices as we believe the predictability of future earnings is a key part of an allocation to infrastructure and we do not believe commodity prices are predictable. Hence, the investment portfolio has not benefited from the elevated commodity prices that have prevailed over recent years. However, in years when oil prices decline the investment portfolio can be expected to perform strongly relative to the benchmark and this has indeed been the historical experience of the strategy.

The increase in real interest rates has had a negative impact on the investment performance of infrastructure companies. With inflation remaining stickier than many central banks had anticipated, interest rates – particularly inflation adjusted rates – continued to rise over the year, creating market volatility for infrastructure stocks and acting as a headwind to investment returns. The earnings of infrastructure companies typically are linked to inflation so if inflation increases their earnings also increase. The response of central banks to rising inflation is to raise interest rates and the increase in interest rates typically offsets the increase in earnings so the value of infrastructure assets is largely unchanged. However, if central banks raise interest rates to levels that more than offset the increase in inflation then the inflation-adjusted interest rate increases and the negative impacts of this will more than offset any positive earnings impacts. Hence, the increase in inflation-adjusted interest rates in FY24 has meant the investment performance of infrastructure companies has been subdued. Interest rates appear to have peaked and in an environment of stable interest rates we expect the earnings power of the companies we invest in to be reflected in investment performance as we prepare for the future.

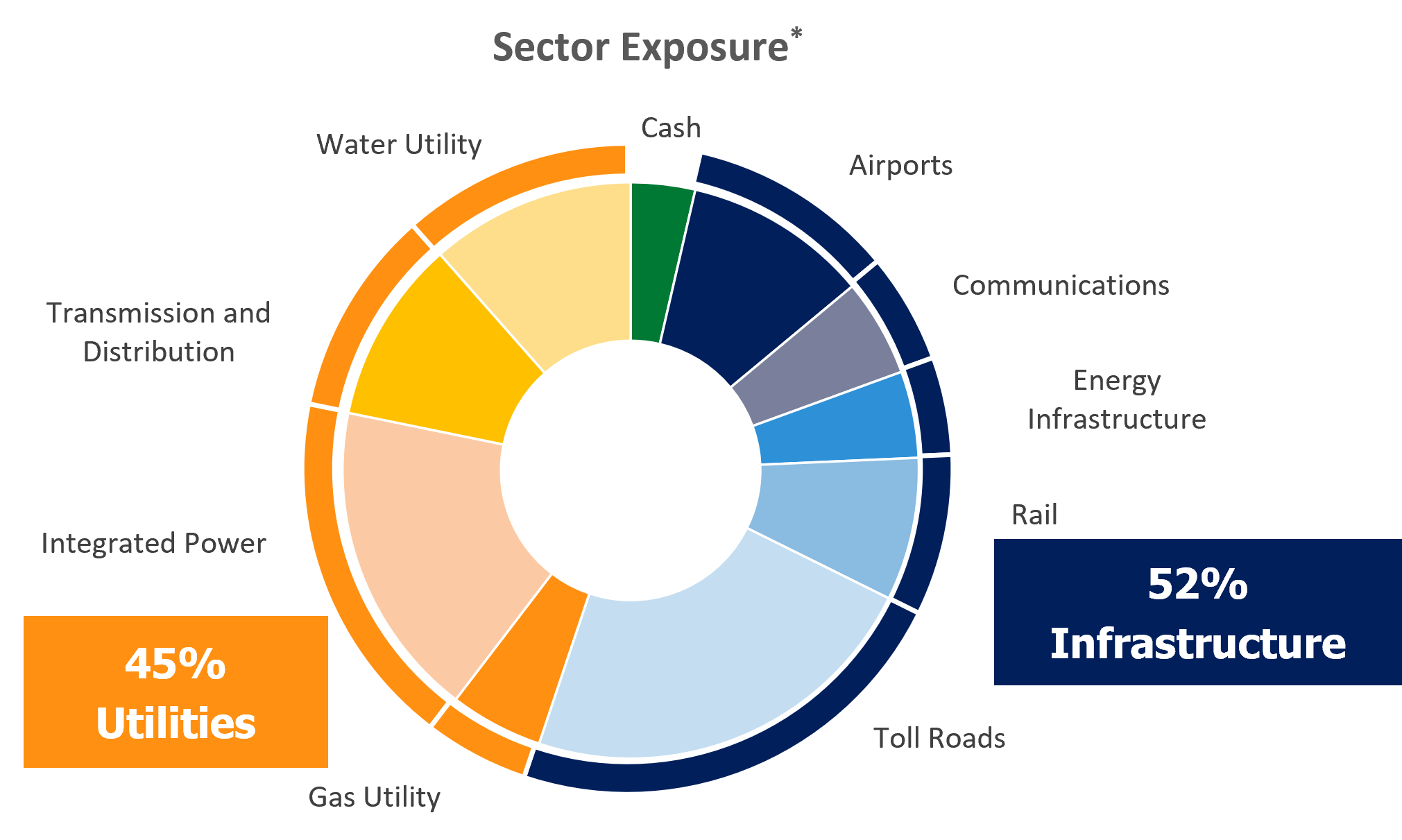

Magellan Infrastructure Fund Exposures as at 30 June 2024

* Magellan defined sectors. Geographical exposures are by domicile of listing. Exposures may not sum to 100% due to rounding.

As the chart above shows, at the end of June 2024 the portfolio comprised approximately equal investment in infrastructure and utilities and a small allocation to cash. While the generation of reliable long-term earnings is a key characteristic of these investments, some sectors in which the portfolio has invested in enjoy attractive long-term structural growth.

The regulated electricity utilities in the portfolio (categorised as ‘integrated power’ and ‘transmission and distribution’ in the chart above) typically operate within regulatory frameworks that protect their earnings against increases in fuel and purchased power costs and changes in customers’ electricity consumption. We view the earnings as relatively low risk with earnings growth largely dependent upon increased capital investment.

Electricity utilities face a huge opportunity for investment to cater for increasing renewables penetration as well as rising power demand from electrification. Investment in an economy’s electricity backbone promotes economic growth, improves manufacturing and technology capabilities and enables decarbonisation – a key step in addressing climate change. In addition, the development of artificial intelligence (AI) and advanced computing have led to increased growth in underlying electricity demand, placing further demands on the capacity and reliability of existing power systems. Consequently, policymakers around the world are encouraging investment in electricity transmission and distribution and other energy infrastructure, which is presenting substantial opportunities for capital investment in these assets. The expected prolonged period of unprecedented investment will lead to long-term earnings growth for electricity utilities.

The portfolio holds investments in electricity utilities in the US and in Europe, operating across both the electricity transmission and distribution sectors. Energy utilities owned in Europe are primarily based in Italy, but we also have investments in Spain and the UK.

European electricity utilities face an enormous wave of capital investment as EU countries strive to match the European Commission’s expansive renewable energy targets. The EU’s renewable energy directive adopted in November 2023 targets EU renewable energy to reach at least 42.5% of final energy consumption by 2030. This compares to the baseline of 23% in 2022 and is a significant increase from the former target of 32% set back in 2018. The objects of these targets are twofold: to decarbonise, and to foster energy independence. In addition, the EU is seeking to decrease fossil fuel consumption in vehicles and shift to electric vehicles, with many countries looking to phase out sales of combustion engine vehicles by 2035. While these targets are ambitious they demonstrate the scale of work being undertaken in Europe and make clear the direction of travel.

Terna, an Italian electricity utility in the portfolio, is an example of the opportunities for European electricity utilities. Terna operates the high-voltage electricity transmission grid in Italy. In March 2024, Terna announced its outlook for the 2024-2028 period, which calls for total capital expenditure of €16.5b, a 65% increase compared to the previous 2022 investment plan. Key investments include new electricity network backbones to better link the south and the north of Italy, with the former offering the best renewables resources while the north is home to the majority of the population and the industrial centres of the country. A similar thematic is playing out in Spain and the UK, where significant capital investment is required to cater to the changing demand profiles.

Like their European counterparts, US electricity utilities face a long-term capital investment opportunity with capital investment the key to earnings growth. The need for capital investment is underscored by the step change in secular electricity demand growth over the past couple of years driven by:

Capital investment required to satisfy demand growth comes on top of the investments driven by the US Inflation Reduction Act (IRA) that was signed into law in August 2022. The IRA-related programs, totalling more than US$300b, provided incentives to develop more renewable energy and accelerate electric vehicle (EV) adoption. EVs themselves are projected to represent 18% of total US electricity demand by 2040 (up from <1% today) according to Bloomberg.

US electricity utilities typically guide to long-term earnings growth of 5-7%. Notwithstanding rising interest rates and cost inflation, the recent financial performances from US electricity utilities held in the strategy have generally met these expectations through regulatory protections and prudent expense management. Companies proved adept at managing cost inflation and limiting customer bill increases. Regulatory decisions during the period (average awarded ROE of ~9.6% versus ~9.5% in the prior year) were generally constructive. In 2024/25 the US electricity utilities sector is expected to continue to deliver consistent financial performance aided by constructive regulation and increasing demand for investment in generation and network infrastructure.

Gas utilities operate within regulatory constructs that protect their earnings against changes in natural gas prices and the volume of customer consumption. The significant investment required to replace and repair ageing gas distribution networks supports attractive earnings growth. The combination of the capital investment with the regulatory frameworks has meant gas utilities have delivered consistent financial results over the past five years notwithstanding the effects of the pandemic and gas price volatility.

While investors have shown concerns about the outlook for gas utilities as the world transitions to an increasingly electrified economy, we believe the risks to the gas utilities business model are limited. The dominant purpose driving gas demand is the heating of buildings; we expect this demand to prove resilient to electrification in the regions where we invest, reflecting the superior economics and technical properties of gas-fired heating relative to alternative methods. In addition, gas utilities have options to transport alternatives to natural gas such as hydrogen and renewable natural gases that will likely provide a more economic pathway to decarbonise many sectors compared to electrification.

While investors have shown concerns about the outlook for gas utilities as the world transitions to an increasingly electrified economy, we believe the risks to the gas utilities business model are limited. The dominant purpose driving gas demand is the heating of buildings; we expect this demand to prove resilient to electrification in the regions where we invest, reflecting the superior economics and technical properties of gas-fired heating relative to alternative methods. In addition, gas utilities have options to transport alternatives to natural gas such as hydrogen and renewable natural gases that will likely provide a more economic pathway to decarbonise many sectors compared to electrification.

We hold two gas utilities in Italy – Snam and Italgas. We view both companies as attractively priced with both offering a dividend yield of more than 7% and that is expected to continue growing.

Water utilities face stable underlying demand for water and wastewater services, which confer on the earnings of these companies a high degree of predictability. The replacement of ageing pipes and water treatment plants coupled with efforts to enhance the resilience of networks against the impacts of climate change support expectations of predictable growth in earnings well into the future.

The key water utility investments in the portfolio are UK-based Severn Trent and United Utilities, which if counted together would constitute the largest holding in the strategy. These companies continued to perform strongly at both operating and financial levels during FY24. Despite this, share price performance lagged our expectations, reflecting the stream of negative headlines about Thames Water, an unlisted water utility. Beyond common sector and geographic exposures, Severn Trent and United Utilities bear little resemblance to Thames Water. The characteristics that distinguish Severn Trent and United Utilities on the one hand and Thames on the other are reflected in gearing levels, achieved returns and the environmental record:

Indeed, while Thames Water sank deeper into financial distress during the second half of 2023, our view is the fundamental prospects for United Utilities and Severn Trent improved. Our view reflects United Utilities and Severn Trent having an accelerating growth outlook, the likelihood of a higher baseline return allowance in the next regulatory period (known as AMP8), and expectations of sustained regulatory outperformance against this baseline return:

While further news regarding Thames may drive increased volatility in the near term, we believe investment markets are pricing the risks associated with Severn Trent and United Utilities indiscriminately and we assess the current prices of these companies to be highly attractive.

Airports have benefited from a continued recovery in post-pandemic aviation levels with demand for leisure destination airports being particularly strong. For the four months ended 30 April 2024 (the most recently available data), the International Air Transportation Association (IATA) reported global passenger demand had increased by 15.5% compared to the same period in 2023. This strength has come despite ongoing issues with the delivery of new aircraft, particularly from Boeing – which slowed production following a door blowout on one of its aircraft in January – and issues with Pratt and Whitney engines, which resulted in a large part of the A320neo fleet grounded for maintenance.

Aena, the owner and operator of the leisure-dominated Spanish airport system, has enjoyed passenger traffic well ahead of 2019 levels (11.4% CYTD) with further growth scheduled for the northern hemisphere summer season. This is despite Ryanair, Aena’s biggest customer, announcing in March it was cutting its summer schedule due to a shortfall in the number of new aircraft it was scheduled to receive from Boeing. This only had limited impacts on Aena as Ryanair cut back other routes, underlining the strength of Spain as a low-cost tourist destination in Europe.

Aena, the owner and operator of the leisure-dominated Spanish airport system, has enjoyed passenger traffic well ahead of 2019 levels (11.4% CYTD) with further growth scheduled for the northern hemisphere summer season. This is despite Ryanair, Aena’s biggest customer, announcing in March it was cutting its summer schedule due to a shortfall in the number of new aircraft it was scheduled to receive from Boeing. This only had limited impacts on Aena as Ryanair cut back other routes, underlining the strength of Spain as a low-cost tourist destination in Europe.

While we would expect traffic growth to moderate over the next year, we see the prospects for Aena as remaining strong, not least because the cap on aeronautical charges (in place since Aena was listed in 2015) comes to an end next year. Given the >30% real decline in charges that has occurred already between 2015 and 2023, there is a prospect of meaningful tariff increases from 2026. Aena’s pricing discussion with the regulator will commence next year.

Toll-road companies in the strategy are among the most structurally advantaged infrastructure assets in the world. Congestion on alternative routes indicates that these assets face limited competition and capture a disproportionate share of incremental growth in traffic. Moreover, concession agreements typically provide for tolls to escalate at CPI or fixed nominal rates above CPI, preserving the real value of cash flows in an inflationary environment. Traffic levels for most of the toll roads we follow are now back above pre-pandemic levels, demonstrating the underlying demand for the efficient transportation these essential assets provide.

Toll roads are a significant allocation of the investment portfolio. Most investors appreciate that established toll roads offer excellent investment characteristics: they operate as near-monopolies with limited impact on usage from increased prices, they offer strong pricing power with most contracts allowing for inflation to be passed onto customers, and they offer significant free cash flow generation with most toll roads requiring only minimal maintenance spend once built.

The two largest toll road investments in the portfolio are Ferrovial and Vinci. These are interesting because while both are notionally European motorway companies, they have very different underlying asset exposures.

Vinci is a French company with a global business portfolio but with its key toll road assets based in France. These are mature assets that have about a decade left to run in the concession. Because of this they are highly cash flow generative. Management is focused on how it can most effectively deploy these surplus cash flows into new profitable investments.

The Vinci share price has been under pressure in recent weeks due to political turbulence after the announcement of a snap election by the Macron government, which has thus far seen the opposition RN party lead in the polls. Investors are concerned as the RN party has previously talked about nationalising toll roads. We view the risk from nationalisation to be modest, with robust and mature concession contracts underpinning the business and France benefiting from a strong judicial system. We consider that ultimately the strong underlying assets will prevail over short-term market sentiment.

Our other key European toll road holding is Ferrovial, which has performed strongly over the year. Ferrovial is a diversified portfolio of businesses including airports, construction and toll roads. The largest contributor to the value we assess for the company is toll roads in North America. The company benefited over the year from:

Ferrovial’s toll road and remaining airport assets remain highly attractive and the company is positioned to benefit from ongoing growth in toll road traffic and aviation.

North American railroads provide an essential service to the freight industry by transporting freight across North America. Rail is typically the most economical option for long-distance shippers, particularly for hauling low-value heavy goods such as minerals and grains.

North American railroad companies operate within duopoly markets, which means competitive pressures are limited. Within each market, the main operators have shown the discipline needed to expand margins while capital intensity, network effects and rights of way create barriers to new entrants. Railroads have demonstrated an ability to more than account for inflation through pricing power.

Key risks for railroads include regulation and economic sensitivity. Regulation of railroads has historically been light-handed, allowing railroad operators to charge rates that support capital investment, assure the repayment of debt, permit the raising of needed equity capital, and cover the effects of inflation while attempting to maintain appropriate market-based competition. Rail companies are exposed to potential fluctuations in the volume of goods transported due to changing economic conditions but long-term underlying demand can be expected to grow with the economy. Over the long term, we expect rail companies to benefit from modest volume growth and progressive improvement in operating efficiency.

Share prices for North American were down slightly over the year the benefit from fading fears of a US recession was offset by a challenging year from an operational perspective, as earnings margins were affected by weaker freight volumes and cost inflation flowing from recent labour contract negotiations. Indeed, margins weakened as an expected volume recovery failed to materialise while the rail companies had added resources in anticipation of higher volumes. This was exacerbated for the Eastern rail companies (CSX and Norfolk Southern), who were both negatively affected by the collapse of a major transportation access bridge in Maryland.

These disruptions further compounded the difficult period for Norfolk Southern, which was the subject of investor activism. The activists were critical of the company’s actions regarding the 2023 train derailment in Ohio as well as the failure to meet performance targets and proposed replacing the chief executive and seven of the company’s 13-member board. Ultimately, the proxy battle resulted in the activists winning three board seats and ousting the Chairperson.

Despite recent challenges for rail, Magellan is positive about the near-term prospects for its rail investments and the longer-term view for the sector. The latest data suggests rail companies have boosted profitability following adjustments to resourcing (relative to volumes), easing cost inflation, and pricing that better reflects improved service. Moreover, a recovery in volumes for the sector points to a return of strong operating leverage that enables earnings growth over the medium term. Longer term, Magellan’s investment thesis for the rail sector is unchanged – competitively advantaged pricing power with tremendous cost efficiencies should equate to significant cash flow generation.

The communications infrastructure assets in the portfolio generate highly defensive earnings streams. Leases over communications tower assets are typically struck with an initial term of five to ten years, provide for multiple renewal terms, and limit the termination rights of tenants. Moreover, lease agreements ordinarily embed rent escalation clauses, with rents typically escalating at a rate of about 3% p.a. in the US and at prevailing inflation rates in international markets.

With mobile data consumption expected to grow at rates of more than 25% p.a. in key international markets over the next five years, communication infrastructure companies in the portfolio are poised to benefit from strong tenancy growth as wireless carriers add cell sites to deliver adequate network coverage. Given the operating leverage inherent in the tower companies’ business models, this revenue growth is expected to yield outsized growth in earnings and cash flow.

Following strong investment by wireless carriers in recent years to deploy new mid-band spectrum and increase 5G coverage, the strategy’s major holdings in the communications infrastructure sector American Tower (AMT) and Crown Castle International (CCI) have observed a moderation in demand as wireless carriers digest the investment and adjust to a higher interest rate environment. This has meant earnings growth has been well below historical levels. However, given the contract structures discussed above, this has had only a minor impact on AMT and CCI and as with prior cycles is likely to prove transient and immaterial to long-term value.

We believe infrastructure assets, with their requisite earnings reliability and linkage of earnings to inflation, offer an attractive long-term investment proposition. Furthermore, given the predictable nature of earnings and the structural linkage of those earnings to inflation, the investment returns generated by infrastructure assets are different from standard asset classes and offer investors valuable diversification when included in an investment portfolio. We expect underlying earnings of infrastructure and utilities companies in our defined investable universe should be reliable and reflect solid growth, making them particularly attractive.

An investment in listed infrastructure can be expected to reward patient investors within a three- to five-year time frame. Taking the investment portfolio in its entirety, and taking into account the advantaged characteristics and favourable prospects of the companies in the portfolio, we remain confident the strategy will meet its objectives of delivering attractive risk-adjusted investment returns over the long term and protecting capital in adverse markets.

Yours sincerely,

Gerald Stack Ben McVicar, CFA Ofer Karliner, CFA

Important Information: Units in the funds referred to herein are issued by Magellan Asset Management Limited ABN 31 120 593 946, AFS Licence No. 304 301 (‘Magellan’). This material is issued by Magellan and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to the relevant Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of funds, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan or the third party responsible for making those statements (as relevant). Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third-party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Further information regarding any benchmark referred to herein can be found at www.magellangroup.com.au/funds/benchmark-information/. Any third-party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third-party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan.