Investing in communication towers

What Are Communications Towers?

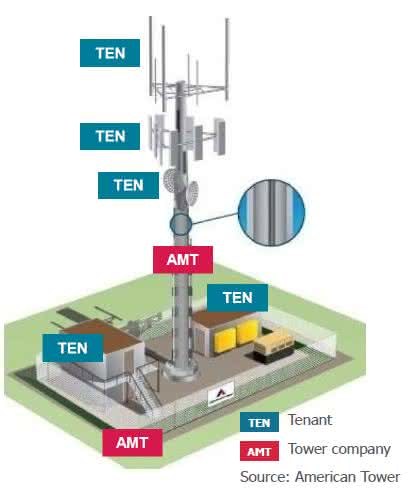

Communications towers are structures designed to hold communications equipment for wireless applications, including mobile telephony, television, radio and public safety communications networks. The towers are typically owned and operated by dedicated companies. These companies generate income primarily through leasing shared tower space to telecommunications providers, such as Verizon and Vodafone. This makes the tower companies effectively an owner of a difficult-to-replicate asset.

Why Are Communications Towers Considered an Infrastructure Asset?

For an asset to meet Magellan's definition of infrastructure, it must satisfy certain criteria:

1. Essential to the Efficient Functioning of a Community

With an increasing need for mobile connectivity to support a growing number of devices we use on a daily basis, communications towers serve as the backbone to the efficient functioning of modern society.

Communications towers allow wireless carriers to provide mobile wireless services to consumers irrespective of economic market conditions.

2. Earnings Are Not Sensitive to Competition, Commodity Price Movements or Sovereign Risk

Towers typically generate reliable earnings for a number of reasons:

> Limited competition:

- Long-term customer contracts (typically about 10 years) with built-in fixed price escalators.

- High switching costs for customers, as moving transmission equipment between towers requires a network redesign, risks disruption to subscribers and incurs a significant cost of physically relocating the equipment. Therefore, the number of customers not renewing contracts is low (1-2% on our estimates).

- It is difficult to build new towers, given regulatory and social hurdles (i.e. nobody wants a large tower in their backyard).

- There is minimal overlap between the competing tower providers’ footprints.

> Towers are typically unregulated and hence face limited sovereign and regulatory risk.

> Towers are not exposed to commodity prices or cycles.

> Telecommunications providers base their multi-year network investment plans on the expected long-term growth in mobile data traffic.

> The majority of tower revenue in any given year is secured through long-term customer contracts.

Types of Communications Towers

MONOPOLE

> 100 - 200 feet

> Typical use: telephone

LATTICE

> 200 - 400 feet

> Also called self-supporting

> Typical use: telephone

GUYED

> 200 - 2,000 feet

> Typical use: television and radio broadcasting, paging and telephony

STEALTH

> Range in size

> Generally used to maintain aesthetic quality of an area

> Particularly useful in areas with strict zoning regulations

Where Do Towers Fit Within an Infrastructure Portfolio?

Tower companies offer investors an opportunity to diversify their infrastructure exposure to the communications sector. Tower installations are essential to the functioning of the growing range of wireless communications devices with minimal incremental costs to providing additional capacity. Their revenues are typically generated through long-term contracts that are structured to grow in line with the underlying costs of operation and adjusted for inflation. The consumption- based nature of wireless communications also provides a link to population growth and future advances in technology.

What Are the Key Revenue Drivers?

A communications tower company’s revenue is driven by the number of towers it owns and operates, the number of tenants per tower, existing tenants adding further equipment and the impact of contracted price escalators. Given the surging growth in global wireless data traffic, which is growing at approximately 50%-plus per annum2, telecommunications providers need to continue investing to increase their capacity, which means more equipment on more towers. This has resulted in more tenants per tower and more revenue per tenant for tower companies. In addition, tower companies have also been able to increase the number of towers in their portfolio through new construction and acquisitions, particularly in many international markets.

2 Per Cisco VNI forecast for 2017-2022.

What Are the Key Costs?

The main cost for communication

tower companies is payments for the land under the towers. The carriers

own the transmission equipment and are responsible for the installation, maintenance and operation of that equipment. Because the tower costs are largely fixed, each incremental tenant or piece of equipment added to the tower generates a significant incremental profit margin (90%-plus).

Once a communications tower is constructed, there is minimal required maintenance expenditure and the structure is built with an expected usable life of over 40 years. Tower providers can make modifications to towers to accommodate additional tenants and equipment, with investment costs shared with the tenant and payback periods of one to two years.

What Are the Risks to the Sector?

There are two key risks to the sector:

1. Alternative Structure

In urban settings, telecommunications providers are increasing their capacity further through network densification (i.e. putting cell transmission sites closer together). They are achieving this by placing antennas on street lights and utility poles. Collectively, these are called ‘small cells’. Towers provide the ubiquitous coverage, while small cells help service hotspots with high wireless traffic demand.

We believe these small cells are complementary rather than substitutes to towers due to the limitations of small cells transmission and relatively high costs. Outside urban settings, there is limited usage of small cells as towers remain far more economical.

2. Carrier Merger Risks

Communications towers are exposed to carrier merger risks. When one telecommunications provider acquires another, it may remove redundant transmission equipment from towers. However, the impact is usually spread over several years rather than immediately following a merger, given the time required to integrate wireless networks and the long-term nature of tower contracts.

Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 (‘Magellan’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan.

.JPG)